UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| þ | Filed by the Registrant | ¨ | Filed by a party other than the Registrant |

| | | |

| CHECK THE APPROPRIATE BOX: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

Pure Storage, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| þ | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | |

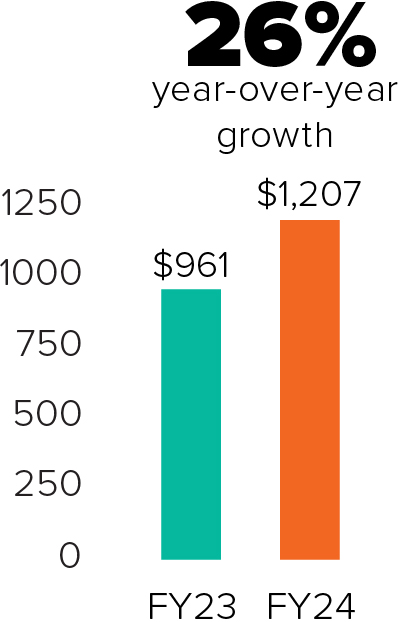

Dear Stockholders, | We are pleased to have delivered another great year. We grew revenues over 25% year-on-year, much faster than"Thank you for being a part of our journey in making Pure Storage the overall market, and continue to increase our profitability as we improve our market share and scale our operations. Most importantly, we continue to deliver the industry’s most advanced, reliable, and efficient products and services, now to more than 11,000 customers across the globe.

Pure’s unique position in the market – delivering data storage products that are high-tech rather than commodities – continues to drive our growth and market share gains. We have many unique attributes in our market, our best-in-class portfolio of products and services, our innovative Evergreen business models, and our customer centricity, as proven by our industry-best Net Promoter Score.

While Pure’s success is attributable to these many factors, I would like to highlight some special milestones of this past year.

Making the all-flash data center a reality

Our vision of the all-flash data center is finally here, and the days of hard disk dominance of data are coming to a close. Each year Pure has made advancements to close the price gap between flash and disk for the broad array of workloads. Still, more than 80% of data in enterprises and the cloud is stored on hard disk drives – despite their complexity, low reliability, and high power, space and cooling needs – because all-flash systems were considered too expensive for low performance unstructured data, until now.

In a major milestoneundisputed leader in the data storage industry, we have recently shipped FlashBlade//E, a scale-out unstructured data repository built for large capacity data stores, priced at the same level as secondary tier all hard disk arrays. Even more exciting is the fact that FlashBlade//E operates at less than one-tenth the power and space required for equivalent capacity hard disk systems,services industry."

Charles Giancarlo Chairman and is more than 10 times more reliable. Together, this provides a lower total cost of ownership compared to the disk alternative, and is the beginning of the end for hard disk usage. As the cost of our flash systems continue to decline, we predict that there will be no hard disks sold five years from now. Contributing to a more sustainable world

Pure’s leadership in the sustainability of data storage products continues to increase. This year, we expanded our environmental impact analysis across our portfolio of products, which found that Pure’s products can use as little as one-fifth the power of competitive storage offerings and up to one-tenth the power of hard disk systems. We also deliver products that require half the floor space and half the e-waste of competitive all-flash products. While we have long known thatCEO, Pure is a more sustainable option in enterprise storage, our value in this area has increased resonance with customers this past year. We project that replacing hard disk storage in data centers with Pure’s flash-based storage can reduce global data center power, space, and e-waste by 20% - a very meaningful reduction in the world of sustainability.

| |

|

Dear Stockholders,

Fiscal 2024 was a pivotal year for Pure as we achieved several major milestones on our way to leading the data storage industry, not only in technology, but market share as well. First, we transitioned from a provider of leading storage products to the provider of the most consistent and comprehensive data storage platform with the introduction of our //E family to replace hard disk systems.

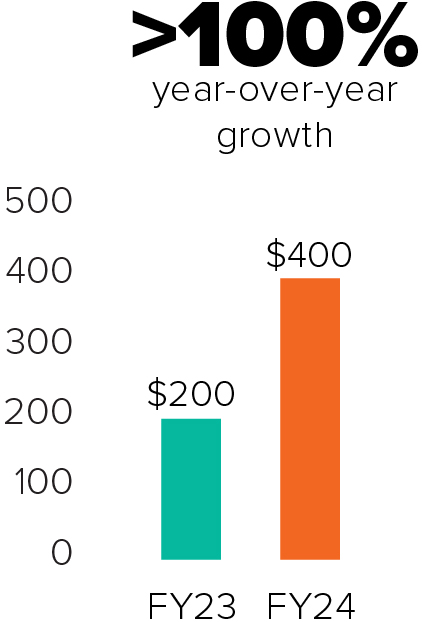

The second major transition in fiscal 2024 was the extraordinary growth of our Evergreen//One as-a-service offering, representing a major shift in our revenue base from sales of product, to sales of storage services. While this shift has a short term impact on our reported revenue growth, it represents a high long term positive impact on the quality and stability of our revenue and earnings.

With the Pure Storage platform, we can now meet the majority of a customer's storage requirements with a uniform software environment, cloud-like efficiency and all-Flash performance. We guarantee customers the ability to avoid the painful re-purchasing and disruptive replacement of outdated mechanical hard disk drive systems every four-to-five years. This promise drove strong demand for our Evergreen subscription services, resulting in subscription revenues reaching 42% of our total revenue.

Over the past year, we catalyzed change in the data storage industry on numerous fronts. Firstly, by introducing our //E family of products, we created a new product category that experienced the fastest sales growth of any new Pure product. For the first time, we now offer a complete range of data storage capabilities to customers, now including bulk storage, signaling that Flash technology is ready to replace hard disk drives in the data center.

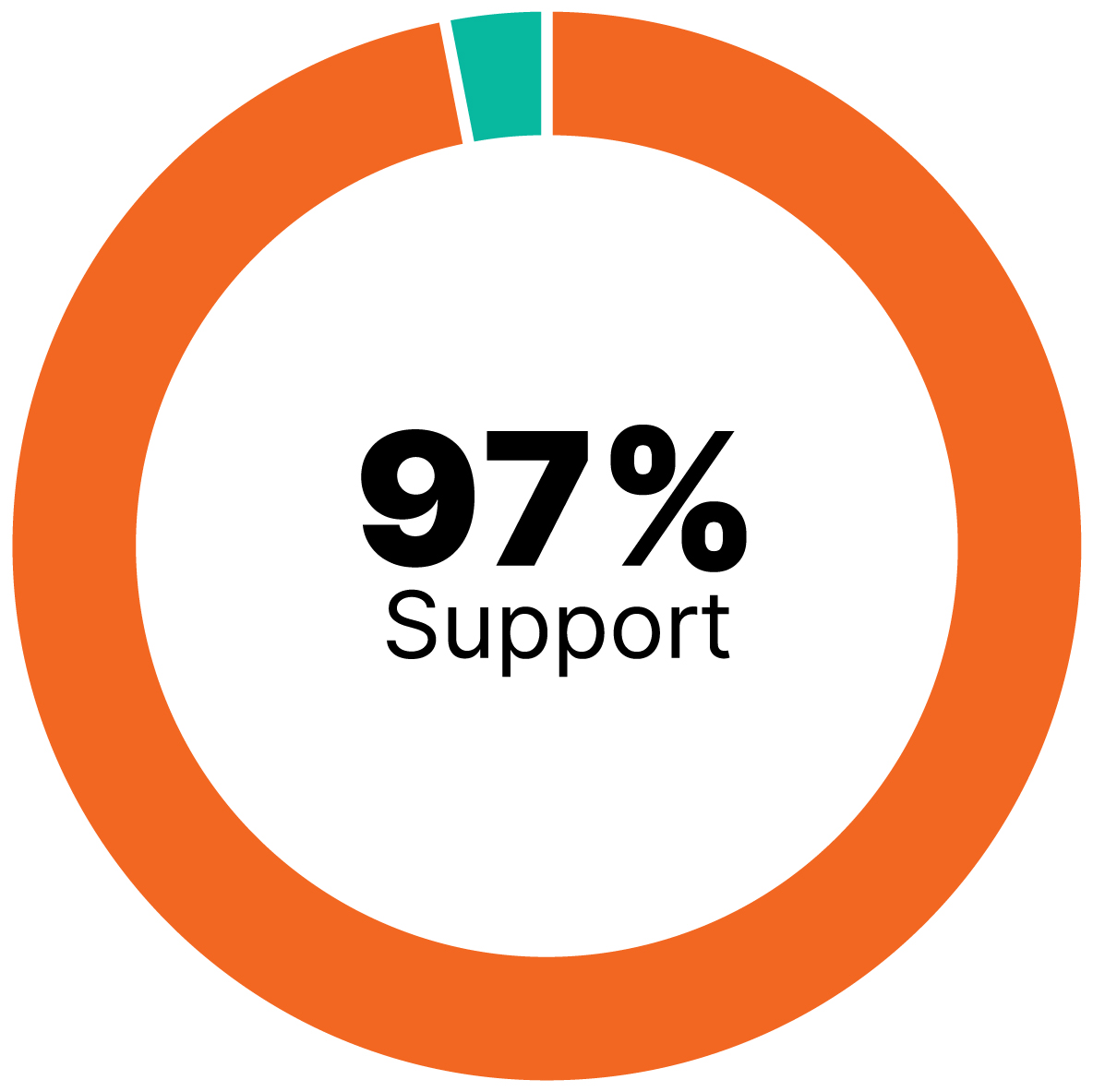

Our commitment to putting customers first is illustrated by our Net Promoter Score (NPS), a standard industry metric—which measures the willingness of customers to positively promote our company. Pure Storage is continually the best NPS in the high tech industry, at 82 last year. It is a testament to how much our customers value and recommend our services.

Our platform strategy is gaining traction with large enterprises. It is proving to be the smarter option for our 12,500 customers to avoid the complexity and risks of managing multiple, fragmented storage systems that are hard to manage and create data silos. A fragmented data environment is a major problem for companies seeking to make the most of artificial intelligence. It holds business back from fully leveraging their own data. Pure stands alone in solving both these issues for our customers, enabling their business to connect data on a single Flash operating and management environment that is fast, reliable, and with ample performance for AI.

Pioneering AI storage innovation since 2017, co-developing our AIRI product with NVIDIA, Pure continues to be our customers’ go-to partner for storage for AI. We persist in our research and development efforts to support AI, which will not only enhance storage capabilities for high-end applications, but we also believe, elevate overall storage performance across the multitude of IT environments. Portworx, our cloud-native storage software platform for Kubernetes, witnessed increased deployment and growth as customers increasingly graduated their container-based development projects to production scale.

Our cloud strategy continued to gain traction in fiscal 2024, as we delivered on our growth pillar of a hybrid cloud architecture and data services for modern applications, aided by partnerships like Microsoft Azure. Our Purity software available on Azure and AWS as Cloud Block Store, offers customers enterprise class storage services which are faster, more compatible and more cost-effective than native cloud services without our software. Pure Fusion enables our customers to manage all of their data across data centers and clouds with unparalleled efficiency, as one unified pool of storage.

| | | | | |

| Pure Storage is saving customers millions of dollars on cloud services while enhancing their use of both private and public clouds and enabling their developers access to customizable data services through APIs. With Pure Fusion, managing data—whether on-premise, or in the cloud—is as simple as using any other cloud service. Over the course of the year, we set a number of remarkable, first-of-a-kind industry standards. From introducing eight new service level agreement (SLAs) guarantees for Evergreen//One that include our groundbreaking Paid Power and Rack program (PPR). PPR pays customers for the costs of electricity and rack space for hosting our Evergreen//One service in their data centers. With Pure products, customers achieve up to 85% reduction in energy use and carbon emissions and up to 95% less rack space than competing offerings. This unique program is only possible because our unique Direct to Flash Purity software is the only software that is able to manage raw Flash, rather than inefficient SSDs. Purity and DirectFlash together provide the most energy-efficient and dependable storage technology in the industry. Our Evergreen//One SLAs also guarantee no change related downtime, no need for future data migrations for hardware updates, and no data loss. 2023 marked a decade of continuous recognition for our industry leadership and continued innovation, with our naming as a leader in the Gartner Magic Quadrants for both Primary Storage and Distributed File Systems & Object Storage for the 10th consecutive year. Additionally, IDC recognized Portworx's industry leadership in their new and latest Kubernetes Container Data Management category. We entered into fiscal 2025 with renewed energy for our mission to store, manage, and protect the world’s data. We have a strong expectation of getting back to double-digit revenue growth and continuing growth from our Evergreen and Portworx subscriptions. Our team is committed to capturing increased market share and pushing the boundaries of cloud and enterprise data storage management, while continuing to focus on changing the energy intensity of data centers by replacing hard disk drives, and minimizing energy consumption, physical space requirements, and electronic waste. We appreciate your ongoing support as partners in Pure Storage. Sincerely, CHARLES GIANCARLO

Chairman and CEO, Pure Storage

Beyond just the environmental benefits, customers are increasingly compelled by their ability to get more out of their storage at a lower total cost of ownership, particularly given the backdrop of increasing energy prices. This year we introduced more ways to help customers achieve energy-efficiency, including the first-of-its-kind Energy Efficiency SLA guarantee for Evergreen//One and the Pure1 Sustainability Assessment to help customers measure and manage their energy use.

Building upon the most innovative portfolio in storage

Pure continues to lead with meaningful innovation in data storage and management. In the past year, we expanded and refreshed our entire FlashBlade product line with the FlashBlade//S family of products. FlashBlade//S is built with a modular architecture that leverages a nearly unlimited scalable metadata architecture, with more than double the density, performance, and power efficiency of previous versions.

Pure also continued to deliver innovation in our services and subscription offerings. Two industry-first services – Pure Fusion, providing automated storage management and storage-as-a-service; and Portworx Data Services which delivers database-as-a-service – became generally available in fiscal 2023. We also extended our as-a-service model across the full suite of Portworx offerings and advanced our portfolio of Evergreen offerings to include the new fleet-level Evergreen//Flex.

In recognition of our continued innovation, Pure was named a leader in the Gartner Magic Quadrants for both Primary Storage and Distributed File Systems & Object Storage, marking our 9th consecutive year as a leader.

We entered our fiscal 2024 with increasing operational excellence coupled with superior products and services. While we are not immune to this year’s more challenging macroeconomic conditions, I remain confident in our ability to execute well and take share. This year will be another in which we grow faster than the market, maintain a strong innovation cycle, and continue to make headway in realizing our vision of the all-flash data center.

Thank you for your continued trust and confidence in our company. Together, we do important work to advance the state of the art in cloud and enterprise data storage management, now while also reducing its current energy, space and e-waste.

Sincerely,

CHARLES GIANCARLO

Chairman and CEO, Pure Storage

| |

|

650 Castro Street, Suite 4002555 Augustine Dr.

Mountain View,Santa Clara, California 9404195054

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | | | | |

| | | | |

| DATE AND TIME | | LOCATION | | RECORD DATE |

June 14, 202312, 2024 at 8:30 am PT | | Via live webcast at www.virtualshareholdermeeting.com/PSTG2023PSTG2024 | | April 17, 20232024 Only stockholders of record at the close of business on the record date may vote at the meeting or any adjournment thereof. |

| | | | |

VOTING PROPOSALS

| | | | | | | | |

| | Board Recommendation |

PROPOSAL 1: To elect three Class IIIII directors to serve until our annual meeting of stockholders in 2026;2027; | | FOR each nominee |

PROPOSAL 2: To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending February 4, 2024;2, 2025; and | | FOR |

PROPOSAL 3: To consider an advisory vote on the compensation of our named executive officers, as described in this proxy statement; andstatement. | | FOR |

PROPOSAL 4:To consider an advisory vote regarding the frequency of advisory votes on the compensation of our named executive officers.

| | Every ONE Year |

These items of business are more fully described in the proxy materials accompanying this notice. In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meeting. This proxy statement and the proxy card or the Notice of Internet Availability of Proxy Materials are first being mailed or made available to all stockholders of record on or about May 5, 2023.3, 2024.

By Order of the Board of Directors

NICOLE ARMSTRONG

Chief Administrative & Legal Officer and Corporate Secretary

Mountain View,Santa Clara, California

May 5, 20233, 2024

| | |

|

| You are cordially invited to attend the virtual annual meeting. Whether you expect to attend the meeting, you are urged to vote and submit your proxy by following the procedures described in the proxy or notice card. Even if you have voted by proxy, you may still vote during the meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote during the meeting, you must follow the instructions from such agent. |

|

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement.

MATTERS TO BE VOTED ON

| | | | | |

PROPOSAL 1: ELECTION OF CLASS IIIII DIRECTORS |

Andrew Brown, John ColgroveJeff Rothschild, Susan Taylor and Roxanne TaylorMallun Yen have been nominated for election as Class IIIII directors. Our board of directors and our nominating and corporate governance committee believe that the director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice to our management team. |

The board of directors recommends a vote FOR each nominee. | |

| | | | | |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

Our board of directors and audit and risk committee (our audit committee) believe that the continued retention of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending February 4, 20242, 2025 is in the best interests of our company and its stockholders. As a matter of good corporate governance, our board of directors is asking stockholders to ratify the audit committee’s selection of the independent registered public accounting firm. |

The board of directors recommends a vote FOR this proposal. | |

| | | | | |

PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

| Our executive compensation program is designed to promote long-term stockholder value creation and support our strategy by encouraging growth while prudently managing profitability and risk, attracting and retaining key talent, and appropriately aligning pay with performance. |

The board of directors recommends a vote FOR this proposal. | |

| | | | | |

PROPOSAL 4:

ADVISORY VOTE REGARDING THE FREQUENCY OF ADVISORY VOTES TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

|

We are required to hold an advisory vote every six years regarding the frequency with which we hold advisory votes on the compensation of our named executive officers. The advisory vote on the compensation of our named executive officers may be held every one, two or three years. We currently hold such an advisory vote every year. |

The board of directors recommends an advisory vote on executive compensation be held every ONE year.

| |

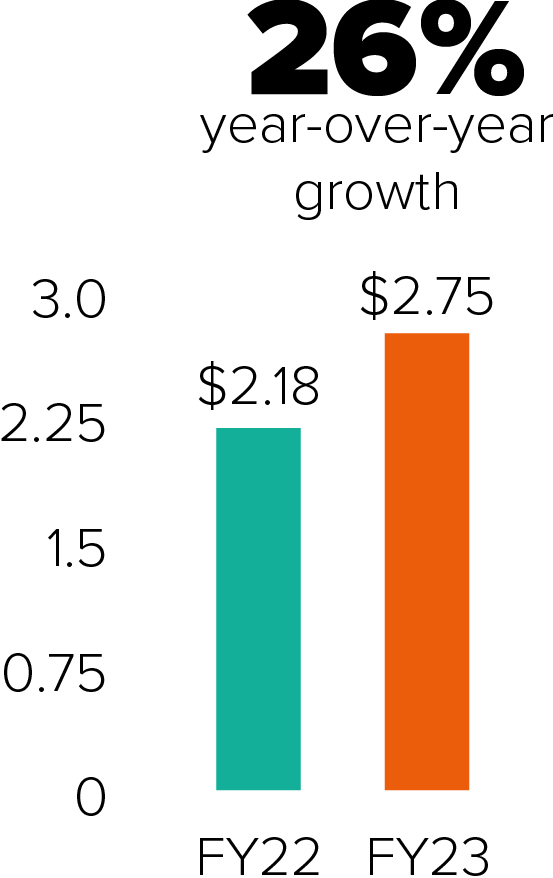

FISCAL 20232024 BUSINESS AND FINANCIAL HIGHLIGHTS

Data is foundational to our customers’ digital transformation, and we are focused on delivering an innovative and disruptive data storage technologies, products and servicesplatform that enableenables customers to maximize the value of their data.

We are a global leader in data storage and management with a mission to redefine the storage experience by simplifying how people consume and interact with data. Our vision of an all-flash data center integrates our foundation of simplicity and reliability with threefour major market trends that are impacting all organizations large and small: (i)(1) increasing demand to consume data storage as a service; (2) the adoption of the cloud operating model everywhere; (ii)shift to modernizing today's data infrastructure with all-flash; (3) the increase of modern cloud-native applications; and (iii)(4) increasing demand for data storage to support the shift to modernizing today’sacceleration in artificial intelligence adoption while managing rising energy costs.

Out data infrastructure with all-flash.

Our products and subscription services supportstorage platform supports a wide range of structured and unstructured data, at scale and across any data workloads in hybrid and public cloud environments, and includeincludes mission-critical production, test and development, analytics, disaster recovery, and backup and recovery.restore, AI and machine learning.

Our highlights for fiscal 2023:2024 include:

•Market-Leading Portfolio Innovation: Pure introduced the newcost-optimized //E Family with FlashBlade//S family of products, built with a modular architecture that leverages a nearly unlimited scalable metadata architecture, offering more than double the density, performance, and power efficiency of previous versions.E, followed by FlashArray//E, enabling customers to leverage flash storage for any workload. Additionally, Pure made two new offerings generally available - Pure Fusiondelivered its largest ever performance, efficiency, and Portworx Data Services.security advancements with the next generation FlashArray//X and FlashArray//C.

•Strong Subscription Services Momentum: Pure extendedset a new industry standard in fiscal 2024 with eight total service level agreements (SLAs) across its as-a-Service model acrossEvergreen portfolio, including the full suite of Portworx offeringsfirst and also advanced its portfolio of Evergreen offeringsonly Paid Power & Rack commitment for Evergreen//One and Evergreen//Flex, in addition to include the new fleet-level Evergreen//Flex.first-of-its-kind energy efficiency and ransomware recovery guarantees.

•Leadership in Sustainability:AI Customer Impact: Pure released the first environmental impact analysiscontinued to add to its 100+ customers across a wide variety of its portfolio, which found that Pure's products canAI use as little as one-fifth the power of competitive storage offerings. Pure also introduced the first-of-its-kind Energy Efficiency SLA guarantee for Evergreen//One.cases, including self-driving cars, financial services, genomics, gaming, manufacturing, and many more.

•Industry Recognition: Pure was named a leader in the Gartner Magic Quadrants for both Primary Storage and Distributed File Systems & Object Storage, marking its 9th10th consecutive year as a leader. Pure was also named one of Fortune's Best Workplacesa leader in Technology.the inaugural IDC MarketSpace: Worldwide Container Data Management 2023 Vendor Assessment.

Looking forward, our multi-facetedfour strategic growth pillars are as follows: (i) grow our subscription services business and drive differentiation with our as-a-Service and Cloud operating model; (ii) expand All-Flash into new use cases served by disk today; (iii) deliver hybrid cloud business objectives include: (i) being a leader in enabling cloud-native applications; (ii) enabling portability ofarchitecture and data services and applications across on-premise and cloud environments; (iii) delivering the full cloud operating model - on-premises or in and across public clouds;for modern applications; and (iv) leadingmeet the transition from disk to flash.customer demand for AI with our energy efficient data storage platform.

CORPORATE GOVERNANCE HIGHLIGHTS

BOARD COMPOSITION SNAPSHOT

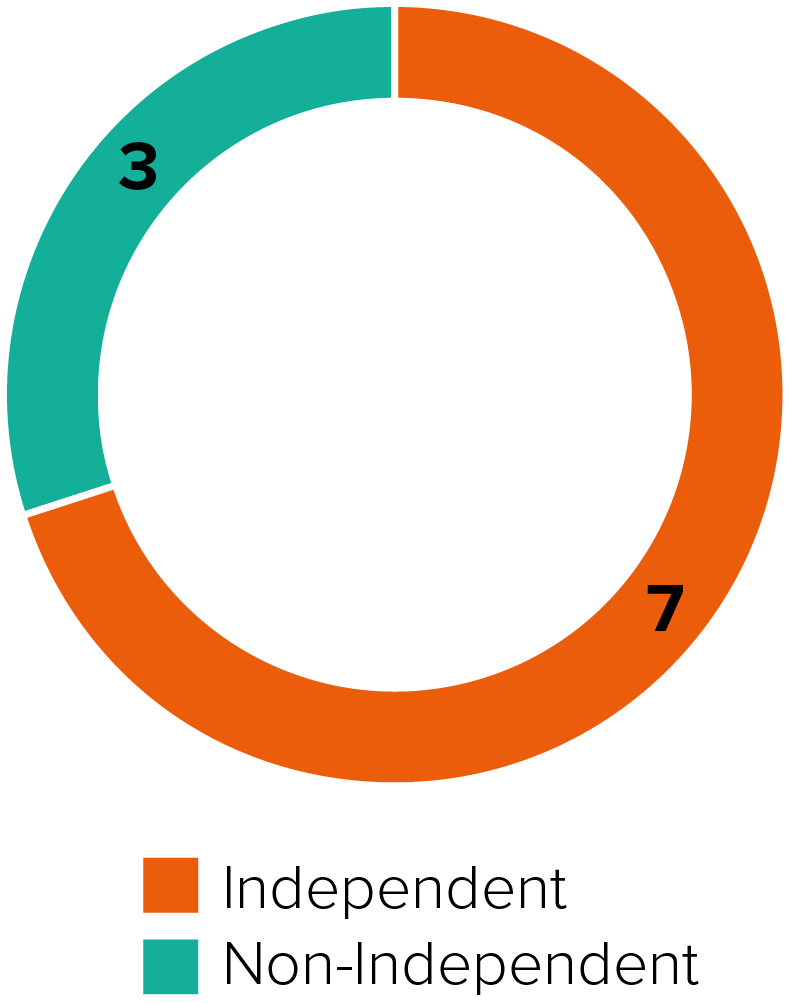

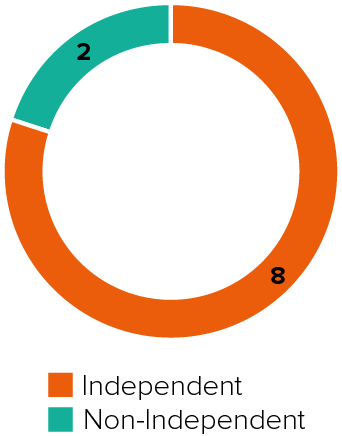

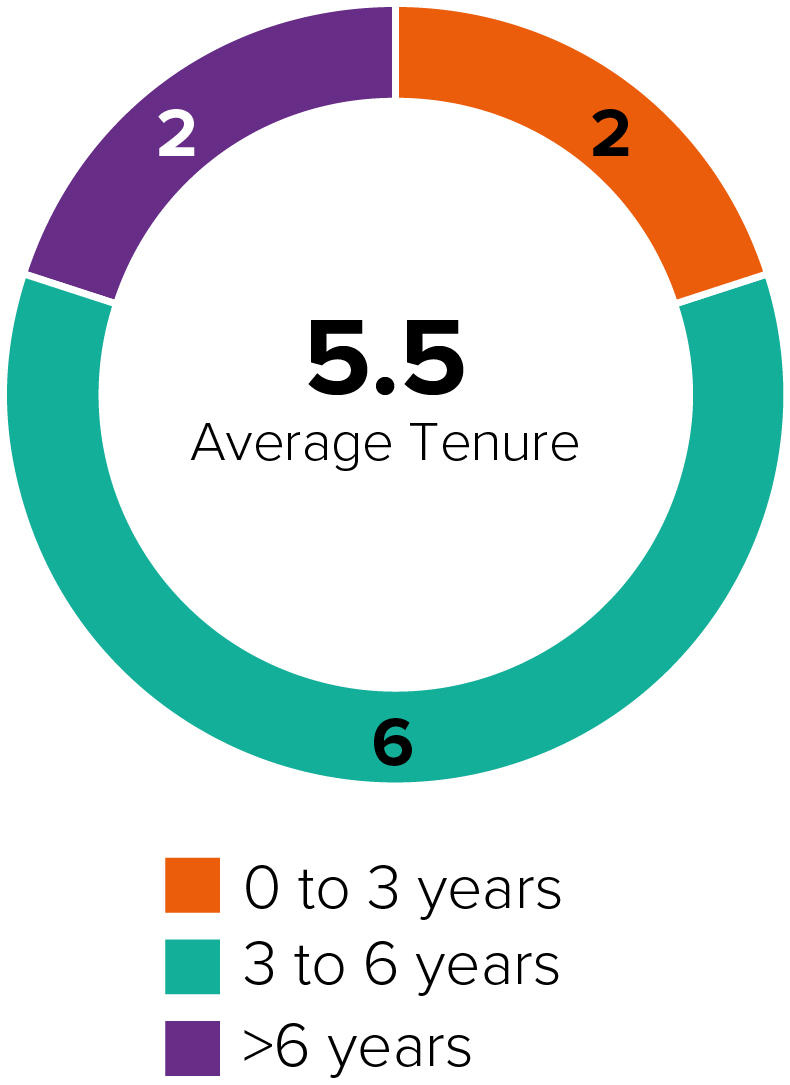

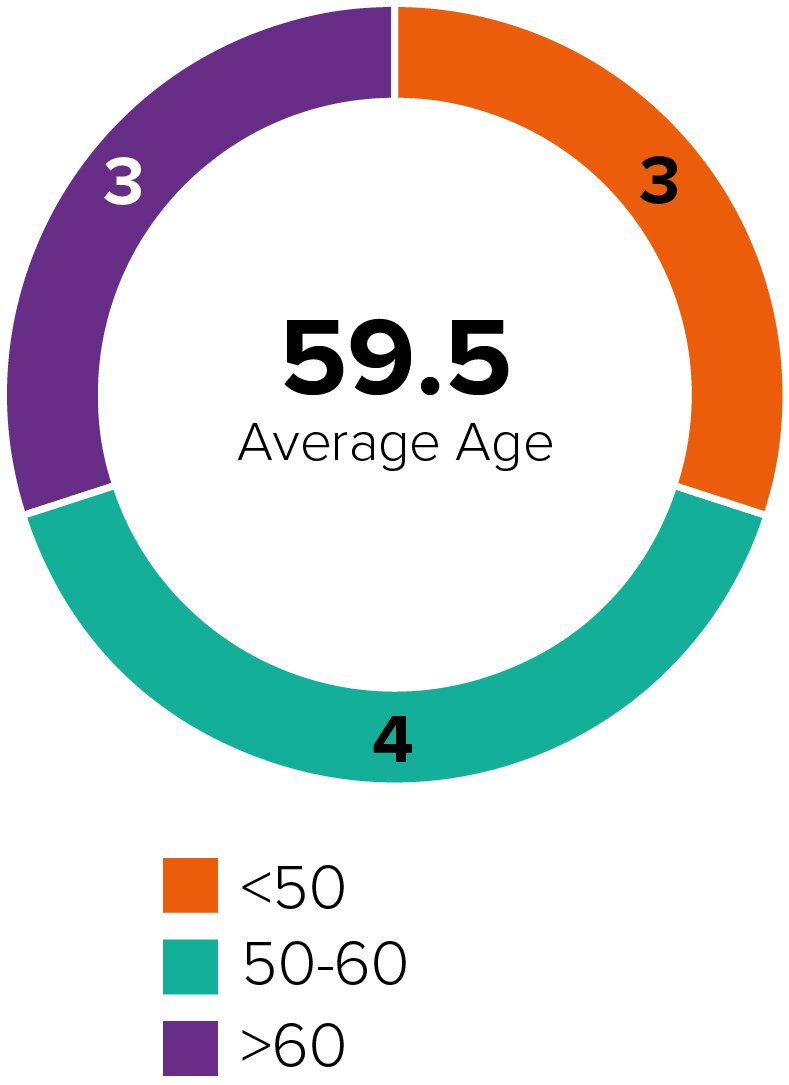

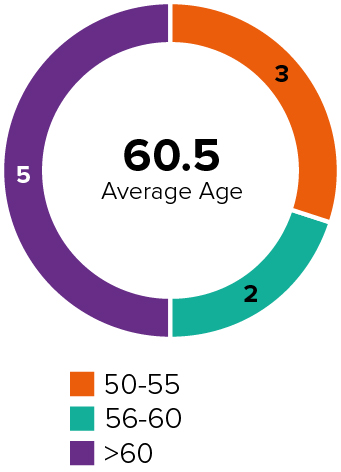

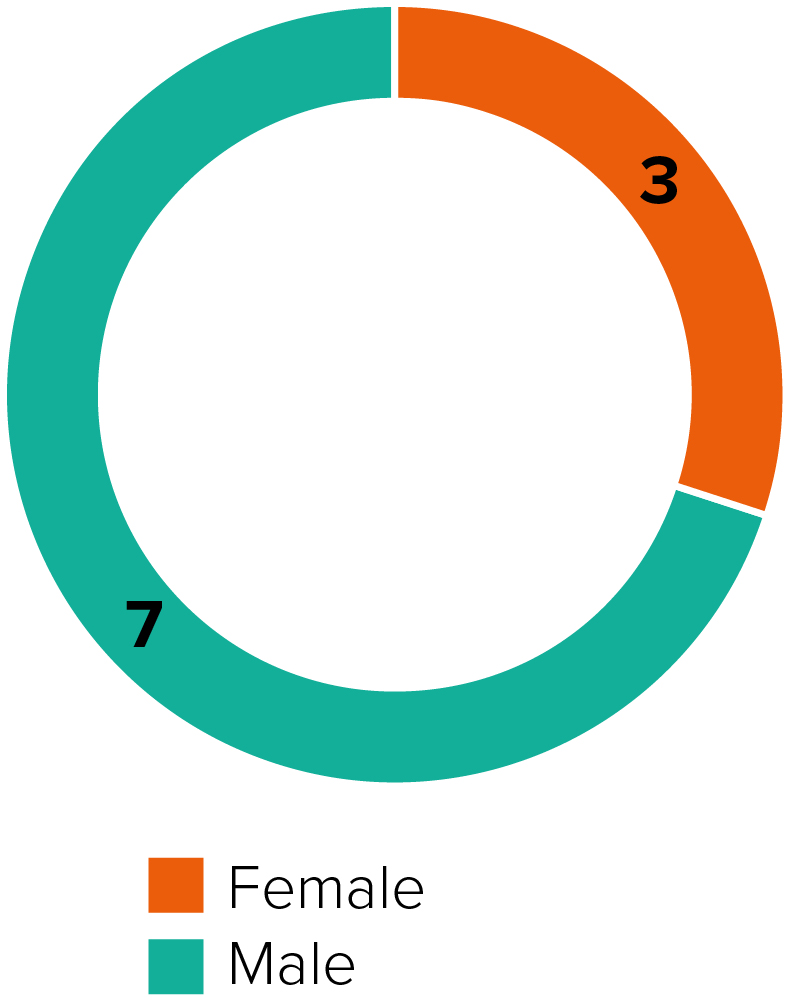

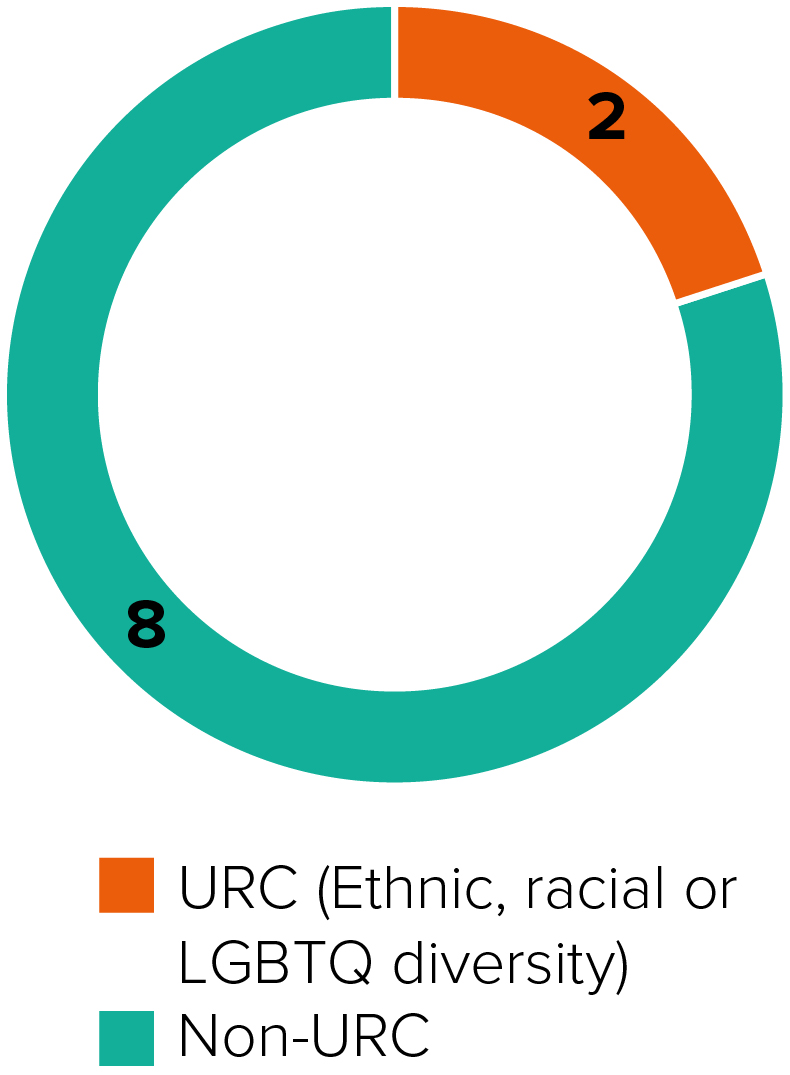

As of April 30, 2023:2024: | | | | | | | | | | | | | | |

| INDEPENDENCE | TENURE | AGE | GENDER | UNDERREPRESENTED COMMUNITIES (URC) |

| | | | |

BOARD MEMBERS

The following table provides summary information about each director nominee and other directors as of April 30, 2023.2024.

| | Board Committees |

| | | | | Board Committees | |

| Name | Name | Class | Age | Independent | Director

Since | Audit

and Risk | Compensation and Talent | Nominating

and Corporate

Governance |

| 2023 Director Nominees | |

| Name | |

| Name | | Class | Age | Indep. | Director Since | Audit and Risk | Compensation and Talent | Nominating and Corporate Governance | Other Public Boards |

| 2024 Director Nominees | |

Jeff Rothschild Former VP of Technology, Facebook | |

Jeff Rothschild Former VP of Technology, Facebook | |

Jeff Rothschild Former VP of Technology, Facebook | | III | 69 | Yes | 2018 | | | | - |

Susan Taylor Former Chief Accounting Officer, Meta Platforms | | Susan Taylor Former Chief Accounting Officer, Meta Platforms | III | 55 | Yes | 2018 | | | | - |

Mallun Yen Founder and General Partner, Operator Collective | | Mallun Yen Founder and General Partner, Operator Collective | III | 53 | Yes | 2021 | | | | - |

| Continuing Directors | |

Andrew Brown Chief Executive Officer, Sand Hill East and Chief Executive Officer and Co-owner, Biz Tectonics | |

Andrew Brown Chief Executive Officer, Sand Hill East and Chief Executive Officer and Co-owner, Biz Tectonics | |

Andrew Brown Chief Executive Officer, Sand Hill East and Chief Executive Officer and Co-owner, Biz Tectonics | Andrew Brown Chief Executive Officer, Sand Hill East and Chief Executive Officer and Co-owner, Biz Tectonics | II | 59 | Yes | 2019 | | | | II | 60 | Yes | 2019 | | | | 1 |

John “Coz” Colgrove Chief Visionary Officer | John “Coz” Colgrove Chief Visionary Officer | II | 60 | No | 2009 | | John “Coz” Colgrove Chief Visionary Officer | II | 61 | No | 2009 | | | | - |

Roxanne Taylor Former Chief Marketing & Communications Officer, Accenture | II | 66 | Yes | 2019 | | | |

| Continuing Directors | |

Scott Dietzen Vice Chairman and Former CEO, Pure Storage | Scott Dietzen Vice Chairman and Former CEO, Pure Storage | I | 60 | No | 2010 | | Scott Dietzen Vice Chairman and Former CEO, Pure Storage | I | 61 | Yes | 2010 | | | | - |

Charles Giancarlo Chairman and Chief Executive Officer | Charles Giancarlo Chairman and Chief Executive Officer | I | 65 | No | 2017 | | Charles Giancarlo Chairman and Chief Executive Officer | I | 66 | No | 2017 | | | | 2 |

John Murphy Former Chief Financial Officer, Adobe Systems | I | 54 | Yes | 2021 | | |

Jeff Rothschild Former VP of Technology, Facebook | III | 68 | Yes | 2018 | | |

Susan Taylor Chief Accounting Officer, Meta Platforms | III | 54 | Yes | 2018 | | | |

Greg Tomb Former President, Zoom and VP Google Cloud | I | 57 | Yes | 2020 | | | |

Mallun Yen Founder and General Partner, Operator Collective | III | 52 | Yes | 2021 | | |

John Murphy Former Chief Financial Officer, Adobe | | John Murphy Former Chief Financial Officer, Adobe | I | 55 | Yes | 2021 | | | | 2 |

Roxanne Taylor Former Chief Marketing & Communications Officer, Accenture | | Roxanne Taylor Former Chief Marketing & Communications Officer, Accenture | II | 67 | Yes | 2019 | | | | 2 |

Greg Tomb President, Censia | | Greg Tomb President, Censia | I | 58 | Yes | 2020 | | | | - |

| | | | | | | | | | | | | | | | | | | | | | | |

| Chair | | Member | | Chair/Financial Expert | | Member/Financial Expert |

EXECUTIVE COMPENSATION HIGHLIGHTS

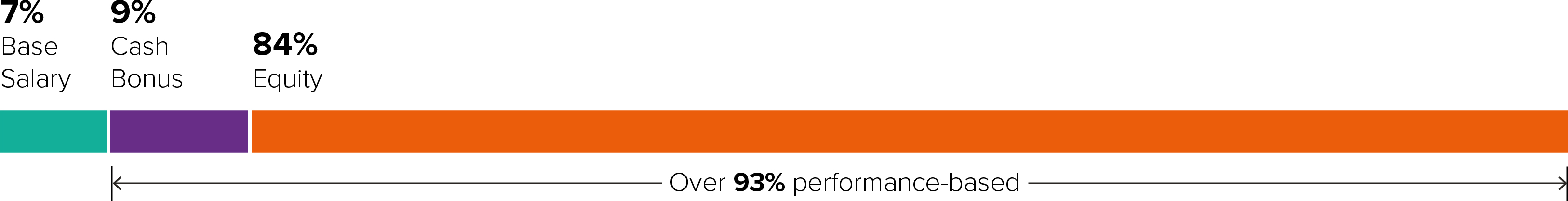

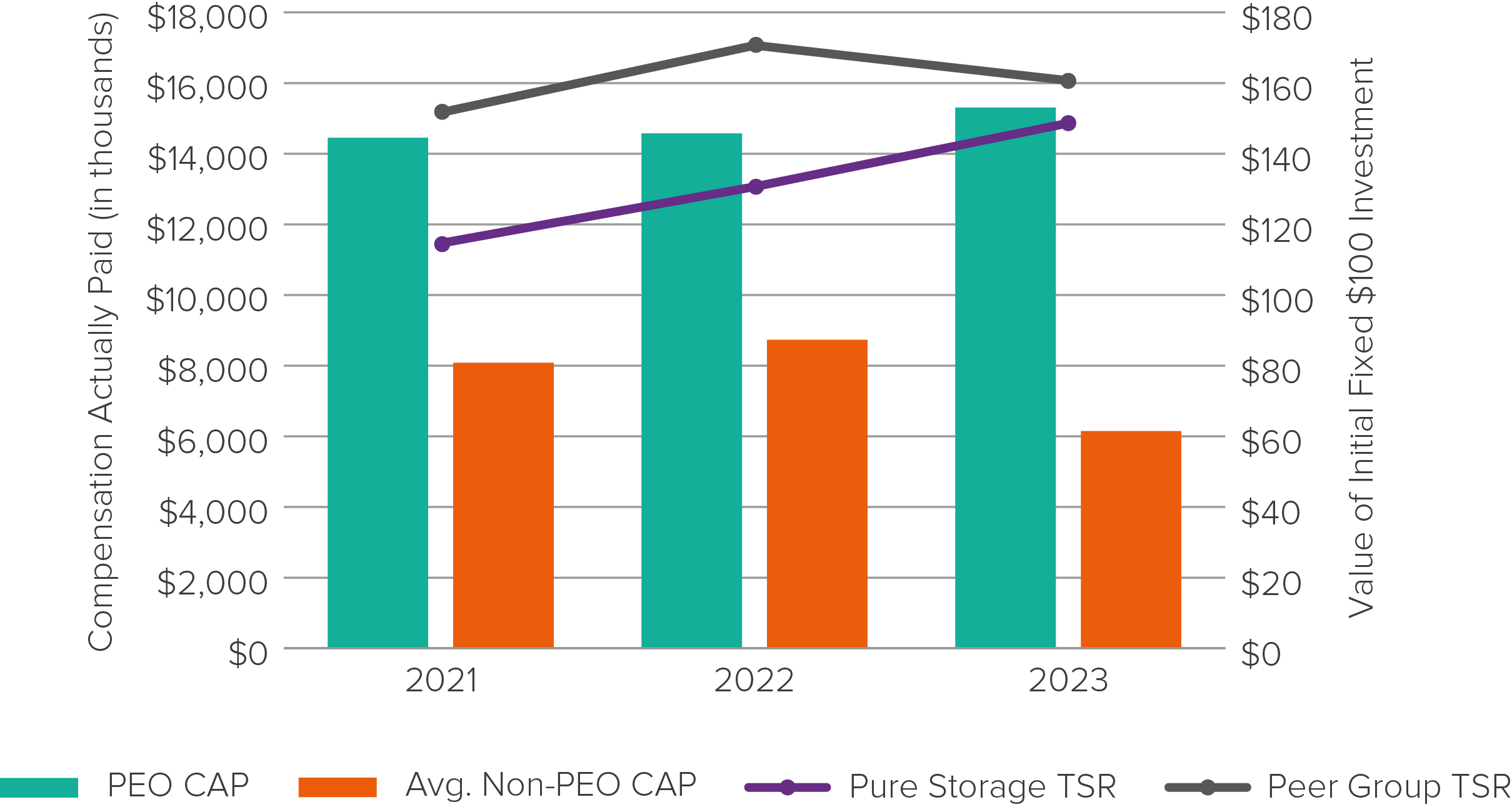

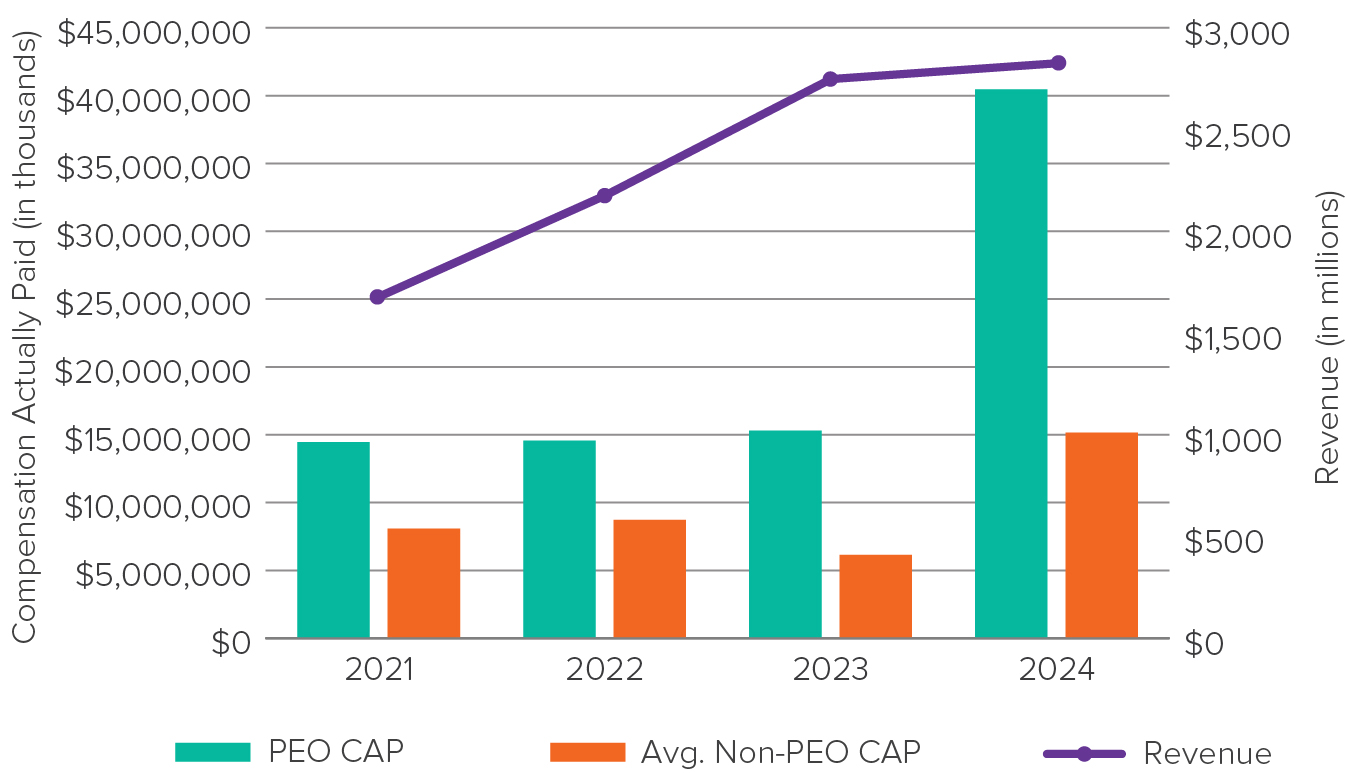

In fiscal 2023,2024, our compensation and talent committee (our compensation committee) approved compensation packages for our executive officers that maintained our robust “pay for performance” philosophy. Fiscal 20232024 cash bonus awards relied on annual revenue, operating profit and customer satisfaction metrics, as well as individual performance. Fiscal 20232024 equity awards were 100% performance-based awards, based on an annual metric that measured growth in revenue and subscription annual recurring revenue (ARR) growth.growth, as ultimately adjusted by our board of directors for stronger-than-expected sales of our Evergreen//One and Evergreen//Flex consumption and subscription-based offerings in fiscal 2024. These equity awards are further subject to time-based vesting over a multi-year period. Our “pay for performance” program produced the intended results. We set targets that were challenging in the face of macro uncertainty -- maintaining 20%+ revenue growth, while increasing profitability, maintaining high customer satisfaction, and growing our subscription ARR.sales and maintaining revenue growth, profitability and high customer satisfaction. While we met profitability and NPS targets, we missed our revenue target, and accordingly, our corporate performance factor for the bonus awards was funded at 76% and the equity awards were earned at 80% of target. We also introduced long-term performance equity awards with a five-year performance period, dependent on significant market capitalization growth. The program is discussed in detail in the section titled “Compensation Discussion and Analysis” below.

OUR EXECUTIVE COMPENSATION PRACTICES

Our executive compensation policies and practices reinforce our “pay for performance” philosophy and ensure that compensation is meaningfully tied to the creation of long-term stockholder value. Listed below are highlights of our compensation policies and practices:

| | | | | | | | |

WHAT WE DO WHAT WE DO | |  WHAT WE DON’T DO WHAT WE DON’T DO |

| | |

•Performance-based cash and equity incentives •Caps on performance-based cash and equity incentive compensation as relates to the corporate performance factor •100% independent directors on our compensation committee •Independent compensation consultant engaged by our compensation committee •Annual review and approval of our compensation strategy •Significant portion of compensation based on corporate metrics •Three-year equity vesting period •Stock ownership guidelines •Policy regarding incentive compensation clawback | | •No “single trigger” change of control payments or benefits •No post-termination retirement or pension-type non-cash benefits •No perquisites other than those available to our employees generally •No tax gross-ups for change of control payments or benefits |

| | |

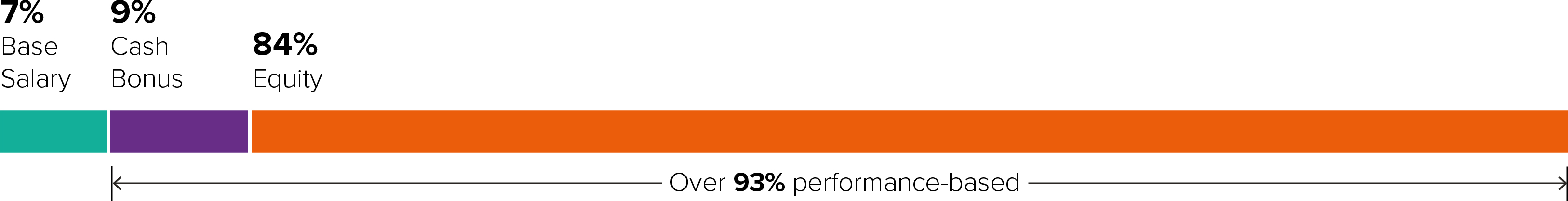

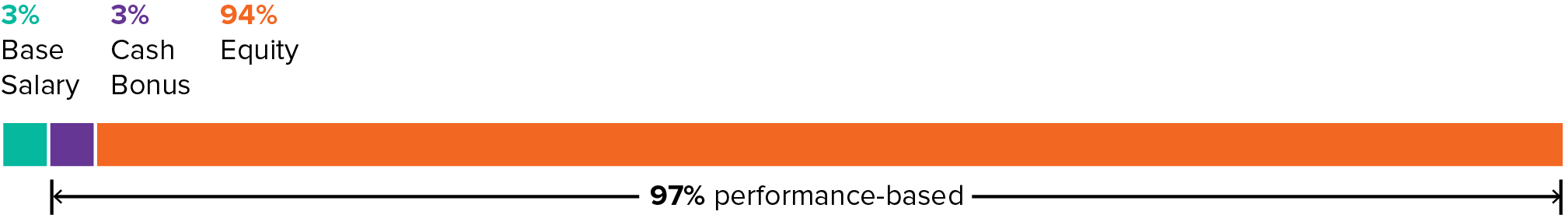

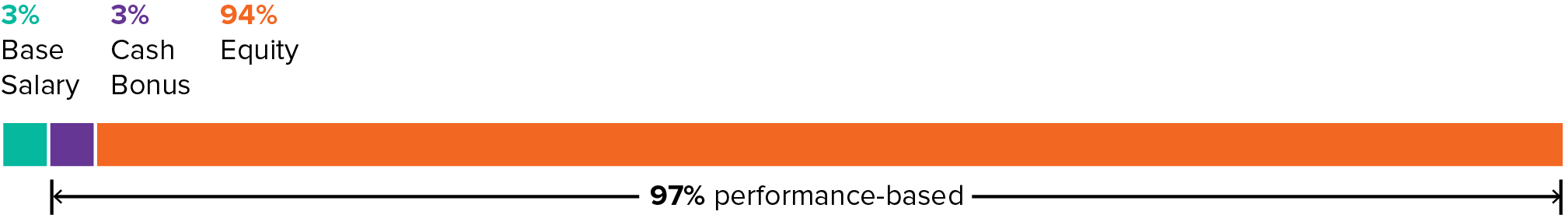

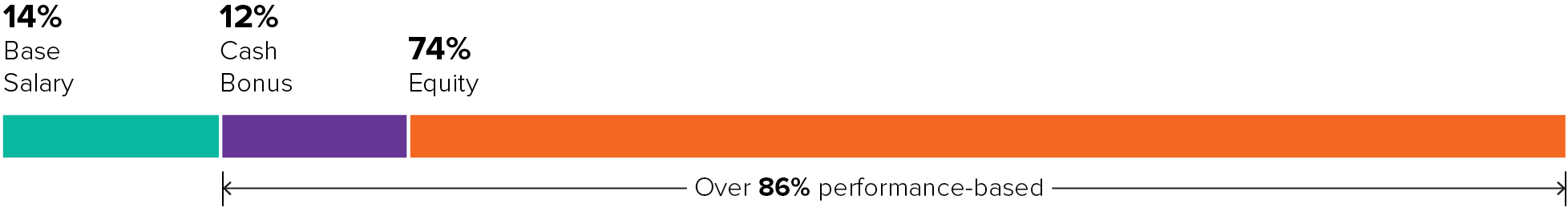

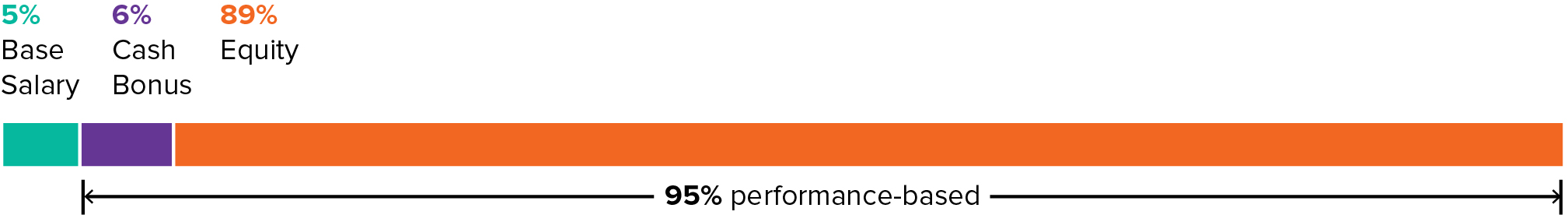

PERFORMANCE-BASED EXECUTIVE OFFICER PAY

The chart below shows the pay components and mix for our Chief Executive Officer for fiscal 20232024 (based on base salary, target cash bonus and grant date fair value of equity award at target). This chart illustrates the predominance of at-risk and performance-based components in our executive compensation program. Our other executive officers have pay packages that are similarly weighted toward performance-based components. We believe these components provide a compensation package that helps attract and retain qualified individuals, focuses the efforts of our executive officers on the achievement of both our short-term and long-term objectives and aligns the interests of our officers with those of our stockholders.

| | |

| CEO - % OF TOTAL TARGET PAY |

|

TABLE OF CONTENTS

650 Castro Street, Suite 4002555 Augustine Dr.

Mountain View,Santa Clara, California 9404195054

PROXY STATEMENT

For the 20232024 Annual Meeting of Stockholders

To Be Held On June 14, 202312, 2024 at 8:30 am PT

Our board of directors is soliciting your proxy to vote at the 20232024 annual meeting of stockholders of Pure Storage, Inc., a Delaware corporation (Pure), to be held virtually, via live webcast at www.virtualshareholdermeeting.com/PSTG2023PSTG2024, originating from Mountain View,Santa Clara, California, on Tuesday,Wednesday, June 14, 202312, 2024 at 8:30 am PT, and any adjournment or postponement thereof.

For the meeting, we have elected to furnish our proxy materials, including this proxy statement and our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (SEC) on April 3, 2023,1, 2024, to our stockholders primarily via the internet. Beginning on or about May 5, 2023,3, 2024, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the Notice) that contains notice of the meeting and instructions on how to access our proxy materials on the internet, how to vote at the meeting, and how to request printed copies of the proxy materials. Stockholders may request to receive all future materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. A stockholder’s election to receive proxy materials by mail or email will remain in effect until revoked. We encourage stockholders to take advantage of the availability of the proxy materials on the internet to help reduce the environmental impact and the cost of our annual meetings.

To attend, vote, and submit questions during the annual meeting visit www.virtualshareholdermeeting.com/PSTG2023PSTG2024 and enter the 16-digit control number included in the Notice or on your proxy card. If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/PSTG2023PSTG2024.

Only stockholders of record at the close of business on April 17, 20232024 (the record date) will be entitled to vote at the meeting. On the record date, there were 307,240,635325,095,040 shares of common stock outstanding and entitled to vote. Each holder of common stock will have the right to one vote per share. A list of stockholders entitled to vote at the meeting will be available for examination during normal business hours for ten days before the meeting at our address above. The stockholder list will also be available online during the meeting. If you plan to attend the meeting online, please see the instructions elsewhere in this proxy statement.

In this proxy statement, we refer to Pure Storage, Inc. as “Pure Storage,” "Pure," "the company," “we” or “us” and the board of directors of Pure as “our board of directors.” Our Annual Report on Form 10-K, which contains consolidated financial statements as of and for the fiscal year ended February 5, 2023 (fiscal 2023)4, 2024 (fiscal 2024), accompanies this proxy statement. You may also obtain a copy of our Annual Report on Form 10-K relating to fiscal 2023,2024, without charge, by writing to our Secretary at our address above.

| | | | | |

| |

PROPOSAL 1 ELECTION OF DIRECTORS |

|

Our board of directors recommends a vote FOR all Class IIIII director nominees. | |

Our board of directors currently consists of ten members. Our board is divided into three classes with each class serving staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election until the third annual meeting following the election. Any directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Andrew Brown, John ColgroveJeff Rothschild, Susan Taylor and Roxanne TaylorMallun Yen are currently directors of Pure and have been nominated to continue to serve as Class IIIII directors. Each of these nominees has agreed to stand for reelection at the meeting. Our management has no reason to believe that any nominee will be unable to serve. If elected at the meeting, each of these nominees wouldwill serve until the annual meeting of stockholders to be held in 20262027 and until his or her successor has been duly elected, or if sooner, until the director’s death, resignation or removal.

Our nominating and corporate governance committee (our governance committee) seeks to assemble a board of directors that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, the governance committee has identified and evaluated nominees in the broader context of our board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities deemed critical to the effective functioning of our board of directors.

VOTE REQUIRED

Directors are elected by a plurality of the votes of the holders of shares present at the meeting or represented by proxy and entitled to vote on the election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by our governance committee.

DIRECTOR NOMINATION AND BOARD REFRESHMENT PROCESS

In evaluating candidates for our board, our governance committee considers such factors as possessing relevant expertise to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the company, having the ability to read and understand basic financial statements, demonstrated commitment to the highest personal integrity and ethics, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. These qualifications may be modified from time to time. The governance committee also considers the board's overall balance of diversity in terms of perspectives, experiences and backgrounds (including corporate backgrounds beyond the executive suite and non-corporate backgrounds), as well as other factors commonly associated with diversity such as diversity of race, ethnicity, gender, age, sexual orientation, veteran status and disability status. The governance committee takes into account the current composition of our board of directors, the operating requirements of the company and the long-term interests of stockholders. To reflect our commitment to diversity, it is the policy of the board of directors that qualified diverse candidates (including race, ethnicity, gender and sexual orientation) shall be included in the pool from which director nominees are considered.

In the case of incumbent directors whose terms of office are set to expire, our governance committee will review the directors’ prior service to us, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the governance committee also evaluates whether the nominee is independent, for NYSE purposes, based upon applicable NYSE listing standards applicableand SEC rules and regulations, and the advice of counsel, if necessary. The governance committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our board of directors. The governance committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to our board of directors.

PROPOSAL 1 - ELECTION OF DIRECTORS

Our governance committee intends to evaluate director candidates recommended by stockholders based on the factors and qualifications discussed above, though it has not implemented a formal policy regarding such process. Our board believes that it is appropriate that the governance committee does not have such a policy because it reviews all candidates in the same manner regardless of the source of the recommendation. The governance committee may in the future implement a formal policy regarding consideration of director candidates recommended by stockholders in the future.stockholders.

Below is a summary of the primary skills, experience and qualifications that our directors bring to our board of directors:

Our board of directors believes that rotation of directors is integral to an effective governance structure. Moreover, rotation brings diverse viewpoints, and new perspectives, and a variety of skills and professional experiences, which are important components of governance and promoting the long-term interests of stockholders. In identifying board candidates, our board of directors seeks candidates with diverse backgrounds and believes that a greater breadth of personal and professional experience improves the quality of decision making and enhances business performance.

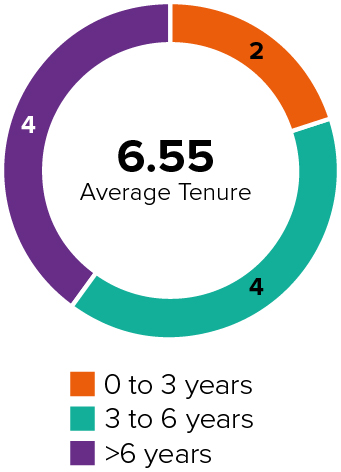

Our board of directors has a balance of new and continuing directors, with an average tenure of approximately 5.56.6 years as of April 30, 2023.2024.

PROPOSAL 1 - ELECTION OF DIRECTORS

NOMINEES FOR ELECTION UNTIL THE 20262027 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | |

| | ANDREW BROWN JEFF ROTHSCHILDIndependent

|

| Age:59 69 | Director Since: September 2019April 2018 |

| | | |

Chief Executive Officer, Sand Hill EastBoard Member

Committee(s): Audit

Compensation (Chair)

Other Public Company Boards: Zscaler

(2015 - present)

Guidewire Software

(2013-2022)Governance

| | BACKGROUND Mr. Brown hasRothschild previously served as Chief Executive Officeran Advisor and Venture Partner at Accel Partners, a venture capital firm, from 1999 to 2022. Mr. Rothschild was the VP of Sand Hill East LLC,Technology at Facebook, a strategicsocial media and technology company, from 2005 to 2015. Mr. Rothschild co-founded Veritas Software Corp., a provider of storage management investmentsolutions, where his role included product strategy, sales and marketing services firm, since February 2014,marketing. Prior to Veritas, Mr. Rothschild worked with a number of companies in the areas of storage management, system software and asnetworking. Mr. Rothschild is the Chief Executive OfficerVice-Chairman of The Vanderbilt University Board of Trustees and Co-Ownera member of Biz Tectonics LLC,the Board of Directors of Stanford Health Care. Mr. Rothschild holds an M.S. in Computer Science and a privately held consulting company, since 2006. From 2010 to 2013, Mr. Brown served as Group Chief Technology Officer of UBS, an investment bank. From 2008 to 2010, Mr. Brown served as head of strategy, architecture and optimization at Bank of America Merrill Lynch, the corporate and investment banking division of Bank of America. From 2006 to 2008, Mr. Brown served as Chief Technology Officer of Infrastructure at Credit Suisse Securities (USA) LLC. Mr. Brown holds a Bachelor of ScienceB.A. in Chemical PhysicsPsychology from University College London.Vanderbilt University. QUALIFICATIONS FOR BOARD SERVICE

Mr. Brown's qualifications for board service include his extensive technology expertise, including as chief technology officer of multiple large financial firms, as well as his service on the boards of other disruptive technology companies, including other public companies.

|

| | | |

| | | | | | | | | | | |

| | JOHN "COZ" COLGROVE |

| Age: 60

| Director Since: October 2009

|

| | | |

Founder and Chief Visionary Officer

Committee(s):

None

| | BACKGROUND

Mr. Colgrove founded Pure in October 2009 and has served as our Chief Visionary Officer since 2021. Mr. Colgrove served as our Chief Technology Officer, from October 2009 to August 2021. In 2009, Mr. Colgrove served as an Entrepreneur in Residence at Sutter Hill Ventures, a venture capital firm. From 2005 to 2008, Mr. Colgrove served as a Fellow and Chief Technology Officer for the Datacenter Management Group of Symantec. Mr. Colgrove was one of the founding engineers and a Fellow at Veritas Software Corp., a provider of storage management solutions, which merged with Symantec in 2005. Mr. Colgrove earned his B.S. in Computer Science from Rutgers University and holds over 250 patents in the areas of system, data storage and software design.

QUALIFICATIONS FOR BOARD SERVICE

Mr. Colgrove’s qualifications for board service include his deep technical expertise and knowledge of data storage systems, requirements and design, and his experience as a leader and innovator involved in emerging technologies and companies, including as Pure's founder.

|

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

| | | | | | | | | | | |

| | ROXANNE TAYLOR Independent

|

| Age: 66

| Director Since: February 2019

|

| | | |

Former Chief Marketing & Communications Officer, Accenture

Committee(s):

Compensation

Governance (Chair)

Other Public Company Boards: Thoughtworks

(2021-present)

Unisys Corp.

(2021-present)

| | BACKGROUND

Ms. Taylor previously served as the Chief Marketing and Communications Officer of Memorial Sloan Kettering, the world’s oldest and largest private cancer center, from February 2020 to October 2022. Ms. Taylor served as Chief Marketing and Communications Officer at Accenture, a global professional services company, from 2007 until 2017. From 1995 to 2007, Ms. Taylor served in various marketing positions at Accenture, including Managing Director Corporate and Financial Communications and Director of Marketing and Communications for the Financial Services practice. Before joining Accenture, Ms. Taylor served in corporate communications, investor relations, and senior marketing positions at Reuters and Citicorp/Quotron from 1993 to 1995 and 1989 to 1993, respectively. Ms. Taylor received a B.A. in Psychology from University of Maryland, College Park.

QUALIFICATIONS FOR BOARD SERVICE

Ms. Taylor’s qualifications for board service include her extensive marketing and communications experience, and knowledge of the technology industry and IT services, as well as the insights she brings from managing public company communications and investor relations, and her public company board experience.

|

| | | |

CLASS III DIRECTORS CONTINUING IN OFFICE UNTIL THE 2024 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | |

| | JEFF ROTHSCHILD Independent

|

Age: 68

| Director Since: April 2018

|

| | | |

Former VP of Technology, Facebook

Committee(s):

Governance

| | BACKGROUND

Mr. Rothschild previously served as an Advisor and Venture Partner at Accel Partners, a venture capital firm, from 1999 to 2022. Mr. Rothschild was the VP of Technology at Facebook, a social media and technology company, from 2005 to 2015. Mr. Rothschild co-founded Veritas Software Corp., a provider of storage management solutions, where his role included product strategy, sales and marketing. Prior to Veritas, Mr. Rothschild worked with a number of companies in the areas of storage management, system software and networking. Mr. Rothschild is the Vice-Chairman of The Vanderbilt University Board of Trustees and a member of the Board of Directors of Stanford Health Care. Mr. Rothschild holds an M.S. in Computer Science and a B.A. in Psychology from Vanderbilt University.

QUALIFICATIONS FOR BOARD SERVICE

Mr. Rothschild’s qualifications for board service include his extensive technical and executive leadership and operational experience within technology companies, as well as his relevant infrastructure knowledge and perspective, particular as a technology vendor and customer.

|

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

| | | | | | | | | | | |

| | SUSAN TAYLOR Independent

|

Age: 54

| Director Since: October 2018

|

| | | |

Chief Accounting Officer, Meta Platforms

Committee(s):

Audit

Compensation

| | BACKGROUND

Ms. Taylor has served as Chief Accounting Officer of Meta Platforms, Inc., a social media and technology company, since April 2017. From 2012 to 2017, Ms. Taylor served as Vice President, Controller, and Chief Accounting Officer of LinkedIn Corporation, a professional social networking company. From 2009 to 2012, Ms. Taylor served as the Vice President, Controller, and Chief Accounting Officer of Silver Spring Networks, Inc., a provider of networking solutions, and from 2008 to 2009, Ms. Taylor served as the Senior Director, Accounting Policy of Yahoo! Inc. Prior to Yahoo!, Ms. Taylor spent over thirteen years at PricewaterhouseCoopers LLP, an accounting firm, in various accounting roles. Ms. Taylor received a Bachelor of Commerce degree from the University of Toronto and is a Certified Public Accountant (inactive) in California.

QUALIFICATIONS FOR BOARD SERVICE

Ms. Taylor’s qualifications for board service include her extensive leadership and financial experience at major cloud, data and software companies, as well as her knowledge and significant technology industry and operational experience.

|

| | | |

| | | | | | | | | | | |

| | MALLUN YEN Independent

|

Age: 52

| Director Since: September 2021

|

| | | |

Founder and General Partner, Operator Collective

Committee(s):

Governance

| | BACKGROUND

Ms. Yen has served as general partner of Operator Collective, a venture capital firm and community that brings in operators from diverse backgrounds into the venture ecosystem, which she founded in December 2018. Previously, she served various roles, including Chief Operating Officer, at SaaStr, a community of SaaS executives, founders, and entrepreneurs, from 2012 to 2019, as Executive Vice President and Chief Business & Product Officer at RPX Corporation, a patent risk management company, where she was employed from 2010 to 2017 and a board member from 2017 to 2018, and Vice President, Worldwide Intellectual Property at Cisco Systems, Inc., where she was employed from 2002 to 2010. Ms. Yen was also the CEO and a board member of ChIPs Network, Inc. an organization she co-founded in 2005 that advances women in technology, law and policy. Ms. Yen holds a Bachelor of Science in Business Administration from California Polytechnic State University – San Luis Obispo and a Juris Doctor degree from University of California, Berkeley School of Law.

QUALIFICATIONS FOR BOARD SERVICE

Ms. Yen's qualifications for board services include her extensive leadership experience at technology companies, particularly her expertise with as-a-Service businesses and her investor perspective, as well as her relevant technology and legal knowledge.

|

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

CLASS I DIRECTORS CONTINUING IN OFFICE UNTIL THE 2025 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | |

| | SCOTT DIETZENVice Chairman

|

Age: 60

| Director Since: October 2010

|

| | | |

Vice Chairman

Committee(s):

None

| | BACKGROUND

Dr. Dietzen has served as our Vice Chairman since September 2018. Dr. Dietzen previously served as our Chief Executive Officer from 2010 to 2017, and as our Chairman from 2017 to 2018. From 2007 to 2009, Dr. Dietzen served in various roles at Yahoo! Inc., an internet technology company, including as Interim SVP of Yahoo! Communications and Communities. From 2005 to 2007, Dr. Dietzen served as President and Chief Technology Officer of Zimbra, Inc., a provider of open source messaging and collaboration software until its sale to Yahoo! in 2007. From 1998 to 2004, Dr. Dietzen served in various roles at BEA Systems, Inc., including as Chief Technology Officer. He had served as VP, Marketing at WebLogic, Inc., which BEA Systems acquired in 1998. He earned a B.S. in Applied Mathematics and Computer Science and a M.S. and Ph.D. in Computer Science from Carnegie Mellon University.

QUALIFICATIONS FOR BOARD SERVICE

Dr. Dietzen’s qualifications for board service include his deep technology background and his extensive leadership experience across a range of technology companies, as well as his understanding and experience as our former CEO within the data storage industry.

|

| | | |

| | | | | | | | | | | |

| | CHARLES GIANCARLOChairman

|

Age: 65

| Director Since: August 2017

|

| | | |

Chairman and Chief Executive Officer

Committee(s):

None

Other Public Company Boards:

Arista Networks (2013-present)

ZScaler

(2016-present)

Accenture plc (2008-2019)

| | BACKGROUND

Mr. Giancarlo has served as our Chief Executive Officer since August 2017, and as our Chairman since September 2018. Mr. Giancarlo previously served as Managing Director, Head of Value Creation and later Senior Advisor at Silver Lake Partners, a private investment firm, from 2007 to 2015, where he focused on investment and business improvement opportunities for Silver Lake’s portfolio companies. Mr. Giancarlo served as Interim President and Chief Executive Officer of Avaya, from 2008 to 2009. Prior to that, from 1993 to 2007, Mr. Giancarlo served in senior executive roles at Cisco Systems, including Chief Technology Officer and Chief Development Officer, leading the introduction of many new technologies including Ethernet Switching, WiFi, IP Telephony and Telepresence. Mr. Giancarlo holds a B.S. in Engineering from Brown University, a M.S. in Electrical Engineering from the University of California, Berkeley, and an M.B.A. from Harvard Business School.

QUALIFICATIONS FOR BOARD SERVICE

Mr. Giancarlo’s qualifications for board service include his extensive executive leadership and operational experience at major technology companies, his broad knowledge of data center technologies and matters relating to corporate governance, his investor perspective and his relevant industry knowledge, including with respect to disruptive B2B technologies.

|

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

| | | | | | | | | | | |

| | JOHN MURPHYIndependent

|

Age: 54

| Director Since: December 2021

|

| | | |

Board member

Committee(s):

Audit (Chair)

Other Public Company Boards:

LegalZoom.com (2021-present)

| | BACKGROUND

Mr. Murphy previously served as Executive Vice President and Chief Financial Officer of Adobe, Inc. from April 2018 to October 2021 and as Senior Vice President, Chief Accounting Officer and Corporate Controller from 2017 to 2018. Prior to joining Adobe, Mr. Murphy served as Senior Vice President, Chief Accounting Officer and Corporate Controller of Qualcomm Incorporated from 2014 to 2017. Prior to joining Qualcomm, he worked at several global companies in a variety of finance and accounting roles. Mr. Murphy is a member of the Advisory Board of the Foundry at Fordham University, which champions student and alumni entrepreneurship and social impact. He holds an M.B.A. from the Marshall School of Business at the University of Southern California, and a B.S. in Accounting from Fordham University and is a licensed CPA (inactive).

QUALIFICATIONS FOR BOARD SERVICE

Mr. Murphy’s qualifications for board service include his extensive management and financial experience at major technology companies, including as-a-Service transitions, his familiarity with corporate governance and risk management, as well as his relevant technology industry knowledge and public company board experience.

|

| | | |

| | | | | | | | | | | |

| | GREG TOMBIndependent

|

Age: 57

| Director Since: February 2020

|

| | | |

Board member

Committee(s):

Compensation

| | BACKGROUND

Mr. Tomb previously served as President, Zoom Video Communications, from June 2022 to March 2023. Prior to Zoom, Mr. Tomb served as Vice President of Google's Workspace, Geo and Security Sales at Google Cloud, a cloud computing services company, from April 2021 to June 2022. Mr. Tomb worked at SAP, a multinational provider of enterprise application software and software-related services, from 2003 to 2021, serving as President of SAP Cloud Sales and GTM from March 2020 to April 2021, and as President of SAP SuccessFactors, from July 2017 to March 2020. He previously held responsibilities for SAP's HANA Enterprise Cloud business, SAP's Global Services Organization and SAP North American Business Unit. In addition to SAP, Mr. Tomb served as Chief Executive Officer of Vivido Labs and has held leadership positions at both Accenture Consulting and Comergent Technologies. Mr. Tomb holds a B.S. in Engineering from Pennsylvania State University and an M.B.A from Loyola University of Chicago.

QUALIFICATIONS FOR BOARD SERVICE Mr. Rothschild’s qualifications for board service include his extensive technical and executive leadership and operational experience within technology companies, as well as his relevant infrastructure knowledge and perspective, particular as a technology vendor and customer. |

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

| | | | | | | | | | | |

| | SUSAN TAYLOR Independent |

Age: 55 | Director Since: October 2018 |

| | | |

Board Member Committee(s): Audit Compensation | | BACKGROUND Ms. Taylor previously served as Chief Accounting Officer of Meta Platforms, Inc., a social media and technology company, from April 2017 until June 2023. From 2012 to 2017, Ms. Taylor served as Vice President, Controller, and Chief Accounting Officer of LinkedIn Corporation, a professional social networking company. From 2009 to 2012, Ms. Taylor served as the Vice President, Controller, and Chief Accounting Officer of Silver Spring Networks, Inc., a provider of networking solutions, and from 2008 to 2009, Ms. Taylor served as the Senior Director, Accounting Policy of Yahoo! Inc. Prior to Yahoo!, Ms. Taylor spent over thirteen years at PricewaterhouseCoopers LLP, an accounting firm, in various accounting roles. Ms. Taylor received a Bachelor of Commerce degree from the University of Toronto and is a Certified Public Accountant (inactive) in California. QUALIFICATIONS FOR BOARD SERVICE Ms. Taylor’s qualifications for board service include her extensive leadership and financial experience at major cloud, data and software companies, as well as her knowledge and significant technology industry and operational experience. |

| | | |

| | | | | | | | | | | |

| | MALLUN YEN Independent |

Age: 53 | Director Since: September 2021 |

| | | |

Founder and General Partner, Operator Collective Committee(s): Governance | | BACKGROUND Ms. Yen has served as general partner of Operator Collective, a venture capital firm and community that brings in operators from diverse backgrounds into the venture ecosystem, which she founded in December 2018. Previously, she served various roles, including Chief Operating Officer, at SaaStr, a community of SaaS executives, founders, and entrepreneurs, from 2012 to 2019, as Executive Vice President and Chief Business & Product Officer at RPX Corporation, a patent risk management company, where she was employed from 2010 to 2017 and a board member from 2017 to 2018, and Vice President, Worldwide Intellectual Property at Cisco Systems, Inc., where she was employed from 2002 to 2010. Ms. Yen was also the CEO and a board member of ChIPs Network, Inc. an organization she co-founded in 2005 that advances women in technology, law and policy. Ms. Yen holds a Bachelor of Science in Business Administration from California Polytechnic State University – San Luis Obispo and a Juris Doctor degree from University of California, Berkeley School of Law. QUALIFICATIONS FOR BOARD SERVICE Ms. Yen's qualifications for board services include her extensive leadership experience at technology companies, particularly her expertise with as-a-Service businesses and her investor perspective, as well as her relevant technology and legal knowledge. |

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

CLASS I DIRECTORS CONTINUING IN OFFICE UNTIL THE 2025 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | |

| | SCOTT DIETZENVice Chairman, Independent |

Age: 61 | Director Since: October 2010 |

| | | |

Vice Chairman Committee(s): None | | BACKGROUND Dr. Dietzen has served as Chief Executive Officer of Augment, Inc., a computer software company, since April 2023. Dr. Dietzen has served as our Vice Chairman since September 2018. Dr. Dietzen previously served as our Chief Executive Officer from 2010 to 2017, and as our Chairman from 2017 to 2018. From 2007 to 2009, Dr. Dietzen served in various roles at Yahoo! Inc., an internet technology company, including as Interim SVP of Yahoo! Communications and Communities. From 2005 to 2007, Dr. Dietzen served as President and Chief Technology Officer of Zimbra, Inc., a provider of open source messaging and collaboration software until its sale to Yahoo! in 2007. From 1998 to 2004, Dr. Dietzen served in various roles at BEA Systems, Inc., including as Chief Technology Officer. He had served as VP, Marketing at WebLogic, Inc., which BEA Systems acquired in 1998. He earned a B.S. in Applied Mathematics and Computer Science and a M.S. and Ph.D. in Computer Science from Carnegie Mellon University. QUALIFICATIONS FOR BOARD SERVICE Dr. Dietzen’s qualifications for board service include his deep technology background and his extensive leadership experience across a range of technology companies, as well as his understanding and experience as our former CEO within the data storage industry. |

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

| | | | | | | | | | | |

| | CHARLES GIANCARLOChairman |

Age: 66 | Director Since: August 2017 |

| | | |

Chairman and Chief Executive Officer Committee(s): None Other Public Company Boards: Arista Networks (2013-present) ZScaler (2016-present) Accenture plc (2008-2019) | | BACKGROUND Mr. Giancarlo has served as our Chief Executive Officer since August 2017, and as our Chairman since September 2018. Mr. Giancarlo previously served as Managing Director, Head of Value Creation and later Senior Advisor at Silver Lake Partners, a private investment firm, from 2007 to 2015, where he focused on investment and business improvement opportunities for Silver Lake’s portfolio companies. Mr. Giancarlo served as Interim President and Chief Executive Officer of Avaya, from 2008 to 2009. Prior to that, from 1993 to 2007, Mr. Giancarlo served in senior executive roles at Cisco Systems, including Chief Technology Officer and Chief Development Officer, leading the introduction of many new technologies including Ethernet Switching, WiFi, IP Telephony and Telepresence. Mr. Giancarlo holds a B.S. in Engineering from Brown University, a M.S. in Electrical Engineering from the University of California, Berkeley, and an M.B.A. from Harvard Business School. QUALIFICATIONS FOR BOARD SERVICE Mr. Giancarlo’s qualifications for board service include his extensive executive leadership and operational experience at major technology companies, his broad knowledge of data center technologies and matters relating to corporate governance, his investor perspective and his relevant industry knowledge, including with respect to disruptive B2B technologies. |

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

| | | | | | | | | | | |

| | JOHN MURPHYIndependent |

Age: 55 | Director Since: December 2021 |

| | | |

Board member Committee(s): Audit (Chair) Other Public Company Boards: Roper Technologies (2024-present) LegalZoom.com (2021-present) | | BACKGROUND Mr. Murphy previously served as Executive Vice President and Chief Financial Officer of Adobe, Inc. from April 2018 to October 2021 and as Senior Vice President, Chief Accounting Officer and Corporate Controller from 2017 to 2018. Prior to joining Adobe, Mr. Murphy served as Senior Vice President, Chief Accounting Officer and Corporate Controller of Qualcomm Incorporated from 2014 to 2017. Prior to joining Qualcomm, he worked at several global companies in a variety of finance and accounting roles. Mr. Murphy is a member of the Advisory Board of the Foundry at Fordham University, which champions student and alumni entrepreneurship and social impact. He holds an M.B.A. from the Marshall School of Business at the University of Southern California, and a B.S. in Accounting from Fordham University and is a licensed CPA (inactive). QUALIFICATIONS FOR BOARD SERVICE Mr. Murphy’s qualifications for board service include his extensive management and financial experience at major technology companies, including as-a-Service transitions, his familiarity with corporate governance and risk management, as well as his relevant technology industry knowledge and public company board experience. |

| | | |

| | | | | | | | | | | |

| | GREG TOMBIndependent |

Age: 58 | Director Since: February 2020 |

| | | |

President, Censia Committee(s): Compensation | | BACKGROUND Mr. Tomb has served as President of Censia, a talent intelligence platform, since October 2023. Mr. Tomb previously served as President, Zoom Video Communications, from June 2022 to March 2023. Prior to Zoom, Mr. Tomb served as Vice President of Google's Workspace, Geo and Security Sales at Google Cloud, a cloud computing services company, from April 2021 to June 2022. Mr. Tomb worked at SAP, a multinational provider of enterprise application software and software-related services, from 2003 to 2021, serving as President of SAP Cloud Sales and GTM from March 2020 to April 2021, and as President of SAP SuccessFactors, from July 2017 to March 2020. He previously held responsibilities for SAP's HANA Enterprise Cloud business, SAP's Global Services Organization and SAP North American Business Unit. In addition to SAP, Mr. Tomb served as Chief Executive Officer of Vivido Labs and has held leadership positions at both Accenture Consulting and Comergent Technologies. Mr. Tomb holds a B.S. in Engineering from Pennsylvania State University and an M.B.A from Loyola University of Chicago. QUALIFICATIONS FOR BOARD SERVICE Mr. Tomb's qualifications for board service include his extensive leadership and sales expertise at enterprise technology companies, with a focus on sales and implementation of enterprise and cloud-based business applications. |

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

CLASS II DIRECTORS CONTINUING IN OFFICE UNTIL THE 2026 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | |

| | ANDREW BROWN Independent |

| Age: 60 | Director Since: September 2019 |

| | | |

Chief Executive Officer, Sand Hill East Committee(s): Audit Compensation (Chair) Other Public Company Boards: Zscaler (2015 - present) Guidewire Software (2013-2022) | | BACKGROUND Mr. Brown has served as Chief Executive Officer of Sand Hill East LLC, a strategic management, investment and marketing services firm, since February 2014, and as the Chief Executive Officer and Co-Owner of Biz Tectonics LLC, a privately held consulting company, since 2006. From 2010 to 2013, Mr. Brown served as Group Chief Technology Officer of UBS, an investment bank. From 2008 to 2010, Mr. Brown served as head of strategy, architecture and optimization at Bank of America Merrill Lynch, the corporate and investment banking division of Bank of America. From 2006 to 2008, Mr. Brown served as Chief Technology Officer of Infrastructure at Credit Suisse Securities (USA) LLC. Mr. Brown holds a Bachelor of Science in Chemical Physics from University College London. QUALIFICATIONS FOR BOARD SERVICE Mr. Brown's qualifications for board service include his extensive technology expertise, including as chief technology officer of multiple large financial firms, as well as his service on the boards of other disruptive technology companies, including other public companies. |

| | | |

| | | | | | | | | | | |

| | JOHN "COZ" COLGROVE |

| Age: 61 | Director Since: October 2009 |

| | | |

Founder and Chief Visionary Officer Committee(s): None | | BACKGROUND Mr. Colgrove founded Pure in October 2009 and has served as our Chief Visionary Officer since 2021. Mr. Colgrove served as our Chief Technology Officer, from October 2009 to August 2021. In 2009, Mr. Colgrove served as an Entrepreneur in Residence at Sutter Hill Ventures, a venture capital firm. From 2005 to 2008, Mr. Colgrove served as a Fellow and Chief Technology Officer for the Datacenter Management Group of Symantec. Mr. Colgrove was one of the founding engineers and a Fellow at Veritas Software Corp., a provider of storage management solutions, which merged with Symantec in 2005. Mr. Colgrove earned his B.S. in Computer Science from Rutgers University and holds over 300 patents in the areas of system, data storage and software design. QUALIFICATIONS FOR BOARD SERVICE Mr. Colgrove’s qualifications for board service include his deep technical expertise and knowledge of data storage systems, requirements and design, and his experience as a leader and innovator involved in emerging technologies and companies, including as Pure's founder. |

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

| | | | | | | | | | | |

| | ROXANNE TAYLOR Independent |

| Age: 67 | Director Since: February 2019 |

| | | |

Board Member Committee(s): Compensation Governance (Chair) Other Public Company Boards: Thoughtworks (2021-present) Unisys Corp. (2021-present) | | BACKGROUND Ms. Taylor previously served as the Chief Marketing and Communications Officer of Memorial Sloan Kettering, the world’s oldest and largest private cancer center, from February 2020 to October 2022. Ms. Taylor served as Chief Marketing and Communications Officer at Accenture, a global professional services company, from 2007 until 2018. From 1995 to 2007, Ms. Taylor served in various marketing positions at Accenture, including Managing Director Corporate and Financial Communications and Director of Marketing and Communications for the Financial Services practice. Before joining Accenture, Ms. Taylor served in corporate communications, investor relations, and senior marketing positions at Reuters and Citicorp/Quotron from 1993 to 1995 and 1989 to 1993, respectively. Ms. Taylor received a B.A. in Psychology from University of Maryland, College Park. QUALIFICATIONS FOR BOARD SERVICE Ms. Taylor’s qualifications for board service include her extensive marketing and communications experience, and knowledge of the technology industry and IT services, as well as the insights she brings from managing public company communications and investor relations, and her public company board experience. |

| | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

BOARD OF DIRECTORS ROLE AND RESPONSIBILITIES

RISK OVERSIGHT

Our board of directors oversees an enterprise-wide approach to risk management designed to support the achievement of organizational objectives, including strategic objectives, improve long-term organizational performance, and enhance stockholder value. A fundamental part of risk management is not only understanding the most significant risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for a given company. The involvement of our full board of directors in reviewing our business is an integral aspect of its assessment of management’s tolerance for risk and also its determination of what constitutes an appropriate level of risk.

| | | | | | | | |

| | |

Our audit and risk committee has the responsibility to consider and discuss our major risk exposures and the steps our management has taken to monitor and control these exposures. Our audit committee also monitors compliance with legal and regulatory requirements and our ethics and compliance program, in addition to providing oversight of the performance of our external auditors and our internal audit function. | | Our nominating and corporate governance committee monitors the effectiveness of our corporate governance practices, including our governance guidelines and how successful we are in managing risk. |

| | |

At periodic meetings of our board of directors and its committees, management reports to and seeks guidance from our board and its committees with respect to the most significant risks that could affect our business, such as cyber-security, financial, legal, cyber-security, financial, tax and audit-related risks. Management provides our audit committee periodic reports on our compliance programs and investment policy and practices.

COMPENSATION RISK

Our compensation committee assesses and monitors whether any of our compensation policies, practices and programs has the potential to encourage excessive risk-taking. As part of its annual process, our compensation committee reviewed a risk assessment conducted by management and the committee’s independent compensation consultant to determine whether the design of our employee compensation programs and the amounts and components of employee compensation might create incentives for excessive risk taking by our employees. Based on that review, our compensation committee concluded that the risks arising from our employee compensation programs are not reasonably likely to have a material adverse effect on our company. Our compensation committee believes that our compensation programs encourage employees, including our executives, to remain focused on an appropriate balance of the short-term and long-term operational and financial goals of our company, thereby reducing the potential for actions that involve an excessive level of risk. See the section titled "Compensation Discussion and Analysis" for information regarding relevant features of our compensation programs, such as:

•Our equity awards for executive officers have both performance vesting criteria, as well as time-based vesting criteria, which balances competing short-term and long-term incentives;

•Our equity awards are full value awards and are granted on an annual basis with long-term, overlapping vesting periods to motivate recipients to focus on sustained stock price appreciation;

•Our performance equity and bonus awards contain a cap on maximum payout related to corporate performance;

•Our compensation committee has retained an independent compensation consultant to provide objective advice on matters related to the compensation of our executive officers and non-employee directors; and

•Our compensation committee annually reviews competitive benchmarking data in setting pay mix, targets and long-term incentive elements for our executive officers’ compensation packages.

PROPOSAL 1 - ELECTION OF DIRECTORS

COMPLIANCE AND ETHICS

We pride ourselves on our culture and our company values. We strive to embody these values in everything we do. Just as important are our underlying common principles of Integrity, Honesty, Innovation and Respect for Others—these truly define us and are at the heart of our code of conduct, which applies to all of our directors, officers and employees. Our code of conduct goes beyond merely fulfilling legal requirements—at Pure, conduct counts.

All of our employees are required to complete training courses on our code of conduct and acknowledge and certify compliance with our code of conduct and other key policies on an annual basis. In addition, we conduct mandatory trainings to address compliance risks associated with specific roles in our company. We also maintain an ethicsa Speak Up hotline where employees and third-parties can anonymously report any concerns about possible violations of our code. We thoroughly investigate any information we receive through the hotline or otherwise and take appropriate remedial action when necessary. Conduct counts for our business partners as well. We conduct due diligence on new partners and vendors to confirm compliance with relevant laws. Our business partners are expected to comply with our partner code of conduct and we perform periodic audits to confirm that our code is followed in practice. We plan to disclose future amendments to certain provisions of our code of conduct, or waivers of such provisions applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and our directors, on our website. Our audit committee provides oversight of our ethics and compliance program.

Our board of directors has also adopted a set of guidelines that establish the corporate governance policies pursuant to which our board of directors intends to conduct its oversight of the business of the company in accordance with its fiduciary responsibilities. Our code of conduct, applicable waivers thereof, and our corporate governance guidelines are available in the “Corporate Governance” section of our investor relations website at investor.purestorage.com.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

We strive to deliver highly performant storage technology and solutions while building a sustainable and profitable business, for our customers, partners, investors, employees and for the communities in which we live and work. In 2021,fiscal 2024, we conducted anrefined our assessment to identifyof the most important Environmental, Social and Governance (ESG)(ESG) topics forto address and expanded disclosure to include our company to address.Tier 1, 2 and 3 priorities. The assessmentrefresh was performed byin consultation with a globally recognized and accredited third-party sustainability consultancy firm. These ESG consultancy firm and synthesized feedback from Pure’s leadership team and various key stakeholder groups, including investors, customers and partners.

The top five importantmaterial topics from the analysis form the foundation of our ESG program and report.

•Energy, Emissions and Climate Resilience

•Ethical Business Practices

•Talent Acquisition, Retention & Development

•Diversity, Equity & Inclusion.

•Data Security and Privacy | | | | | | | | | | | | | | |

| | | | |

| TIER 1 | | TIER 2 | | TIER 3 |

| | | | |

Corporate Governance Data Security and Privacy Diversity, Equity & Inclusion. Emissions and Energy Product Sustainability | | Ethics and Compliance Health, Safety and Wellness Responsible Procurement Talent Acquisition, Retention & Development | | Community Engagement Waste Water |

| | | | |

We plan to drive ESG impact by:

•BuildingDelivering sustainable technology infrastructure supportingand operations that reduce energy demand in support of the transition to a net zero carbon emissions and decarbonizationfuture for our employees, customers, and supply chain, and operations.chain.

•Cultivating an entrepreneurial spirit and an inclusive workplace that empowers everyoneAdvancing equitable outcomes for our people by enabling them to achieve breakthrough outcomes, expand their skills, enableachieve professional growth, and support their career goals and pursue professional growth.communities.

•Securely handlingBuilding and managingmaintaining trust with our employees, customers, partners, investors and communities through data focusing onsecurity and privacy, sound governance and leading with ethics and transparency which are essential to maintaining trusted relationships with our customers and key stakeholders.transparency.

PROPOSAL 1 - ELECTION OF DIRECTORS

To ensure properESG GOVERNANCE STRUCTURE

Clear oversight and accountability,strong governance ensures we have operationalized ownership ofthe structure in place to effectively manage risks and opportunities, and drive long-term value creation and business resilience. Our ESG governance model is the structure through which we drive accountability across the company to set and achieve our ESG Program. These are embedded intogoals and objectives, identify new ESG risks and opportunities as they emerge and incorporate feedback from all our technology strategy, business model and culture. stakeholders as their expectations evolve.

Our ESG program governance structure is as follows:

| | | | | |

| |